Published August 23-September 5, 2020

1

Customer Centricity Quiz

“We are a customer-centric company.” We hear this all the time. Yet, many companies lose out to competitors. Their customers surely did not think they were customer-centric! How can you ensure your company is not of those?

Here is a Customer Centricity quiz to help you understand how well your business builds the right relationships with your customers. Give yourself 1 point for every Yes that you answer.

- Do you collect data at every customer touchpoint (offline, online, call centre, etc.)?

- Are you able to get a unified view of every customer?

- Do you know the identity, revenue and profitability contribution of your best customers?

- Can you predict the lifetime value of all your customers?

- Is the lifetime value calculation based on recency AND frequency of customer transactions?

- Is there a differentiated experience that you provide to your best customers?

- Do you use info about your best customers to better target new customer acquisition and onboarding?

- Do you have a referral marketing program targeted at your best customers?

- If a best customer walked into a store or came to your website/app or churned (became inactive), would you know?

- Is measuring and increasing customer loyalty one of the top 3 CEO priorities?

Scoring:

- 8-10: Congratulations! You (and your business) are a Customer Centricity Champion. The next phase is to look at actual implementation. Here are 5 more questions for you – same rules apply (count the number of Yes answers).

- Do you practice the 4Rs philosophy – right message to the right person at the right time via the right channel?

- Are you able to decide on the next best action for every customer to nudge them along in their journey?

- Do you personalise the experience of your customers based on the data you collect?

- Do your emails get delivered to the primary inbox of your customers? Do your push notifications get delivered to a majority (more than 75%) of your customers? (half point for each)

- Do you have a culture of testing every communication for impact?

- 6-7: Customer Centricity Learner. The DNA is there, but there is room for improvement. Look at each of the questions where you answered a No and prepare a plan to make that into a Yes. Your next action should be to convert one No into a Yes every quarter going forward – so pick one of the themes and begin.

- Less than 6: Customer Centricity Newbie. You are leaving a lot of money on the table for competitors. There could be many reasons, but perhaps the most important is that customer centricity needs to immediately become a CEO priority and driven across all departments.

As you would have guessed, the customer centricity quiz is centred around customer loyalty and has embedded in it many ideas for actions that can help grow revenue and profits for your business. Creating lifetime customer loyalty is the most important goal of your business when it starts – and yet, many lose their way with the passage of time opening the way for attack by data-driven, customer relationship-centric, loyalty-obsessed competitors. Bringing the focus back to customer-centricity, attracting the best customers in the category and fostering lifetime loyalty is the key for growing revenues and profits.

2

Loyalty vs VRM

The aspiration of every business is customer loyalty. In simple terms, customer loyalty translates into repeat business. The cost of acquiring a new customer is many times that of retaining an existing customer, hence customer loyalty also means higher profits for a business. If customer churn, a business cannot create a growth story and a profits flywheel. Thus, customer loyalty is central for business success.

I started thinking more deeply about customer loyalty during recent conversations with CMOs as part of the meetings I have been doing on Velvet Rope Marketing (VRM). VRM is about a focus on the Best Customers – the top 20% or so customers who account for a disproportionately high share of revenue and profits. For many businesses, Best Customers can deliver 60% or more revenues and greater than 100% of the profits – since many of the Rest Customers can be loss-making when acquisition and servicing costs are factored in. VRM’s key thesis is that Best Customers need a differentiated experience because of their importance to the business.

Loyalty programmes are one way to reward customers. The more a customer spends, the more points they earn. These points can in turn be redeemed for rewards. To make it more lucrative for loyal customers, tiers can be created where higher tiers generate more points. Airlines do this very well. There is hardly a frequent flyer to be found who is not part of the airline’s loyalty program.

As I see it, there are some very big differences between the standard loyalty programs offered by brands and VRM. Typically, anyone can opt-in to a loyalty program and start earning points. The brand does not control who joins. There is also very little experience differentiation – the points are linked to spending, and that’s about it. In VRM, it is the brand which decides who gets to be part of the differentiated experience. Think of VRM as ‘By Invitation Only’, an exclusive club whose entry is decided by an algorithm which calculates Customer Lifetime Value (CLV), a forward-looking and predictive metric based on the expected future transactions and their value. CLV, as used for VRM, can be a better measure of segmenting customers and determining Best Customers.

Any brand can offer a loyalty program with rewards. Customer Experience differentiation via VRM for Best Customers can become the moat a brand builds to ensure greater customer loyalty, higher spending and a ‘profits monopoly.’ This can give us a new definition for customer loyalty – receiving more than 50% of the spending by a customer in the category. We will build on these ideas in this series.

3

Customer Pyramids

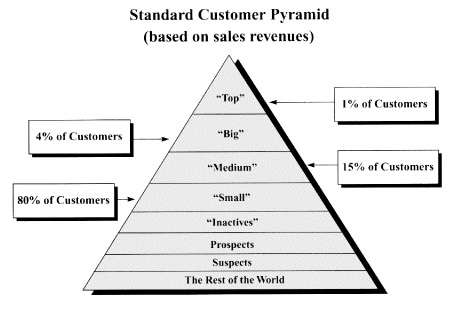

The ideas of customer loyalty are not new. A friend recommended a book published in 2000 – “The Customer Marketing Method” by Jay Curry and Adam Curry. The book discusses the customer pyramid as shown below:

The simple 3-step customer marketing strategy as outlined by the authors is:

- Get new customers into your pyramid.

- Move customers higher in your pyramid.

- Keep customers from leaving the pyramid.

In other words, acquisition, retention and development of customers.

The authors also outline 10 lessons they have learnt from customer pyramids:

- The top 20% of the customers deliver 80% of revenues

- The top 20% of the customers deliver more than 100% of profits.

- Existing customers deliver up to 90% of revenues.

- The bulk of marketing budgets is often spent on noncustomers.

- Between 5% and 30% of all customers have the potential for upgrading in the customer pyramid.

- Customer satisfaction is critical for migration up the pyramid.

- Reasonably satisfied customers often defect to the competition.

- Marketing and sales are responsible for influencing customer behavior.

- Other departments and people also influence customer behavior—for better or worse.

- A 2% upward migration in the customer pyramid can mean 10% more revenues and 50% more profit!

Many of the lessons are timeless. A small fraction of customers account for disproportionate share of revenues and profits – think of these as the Best Customers. To paraphrase George Orwell’s famous quote in Animal Farm, “All customers are equal, but some customers are more equal than others.” Marketing efforts must focus on these customers, even as efforts are made to move some of the others (Rest) up to pyramid.

One can call it customer centricity or customer loyalty or any other term. The key to business success remains in identifying the category’s best customers, attracting and retaining them forever, and then getting them to recommend their family and friends. Data and technology make this easier and more competitive. That is where innovative thinking around customer loyalty as manifested in the ideas of Velvet Rope Marketing can make all the difference.

4

Loyalty Today

Let us begin by looking at the current state of customer loyalty.

SendPulse offers a good starting definition of customer loyalty: “Customer loyalty is a measure of a customer’s likeliness to do repeat business with a company or brand. It is the result of customer satisfaction, positive customer experiences, and the overall value of the goods or services a customer receives from a business.”

Here’s more from SendPulse:

When a customer is loyal to a specific brand, they are not easily influenced by availability or pricing. They are willing to pay more as long as they get the same quality product or service they are familiar with and love. Other characteristics of a loyal customer include the following:

-

they are not actively searching for different suppliers

-

they are more willing to refer a brand to their family and friends

-

they are not open to pitches from competing companies

-

they are open to other goods or services provided by a particular business

-

they are more understanding when issues occur and trust a business to fix them

-

they offer feedback on how a brand can improve its products or services

-

as long as there is a need, they will keep purchasing from a business

Hubspot adds:

Customer loyalty is something all companies should aspire to simply by virtue of their existence: The point of starting a for-profit company is to attract and keep happy customers who buy your products to drive revenue.

Customers convert and spend more time and money with the brands they’re loyal to. These customers also tell their friends and colleagues about those brands, which drives referral traffic and word-of-mouth marketing.

Customer loyalty also fosters a strong sense of trust between your brand and customers — when customers choose to frequently return to your company, the value they’re getting out of the relationship outweighs the potential benefits they’d get from one of your competitors.

Since we know that it costs more to acquire a new customer than to retain an existing customer, the prospect of mobilizing and activating your loyal customers to recruit new ones — simply by evangelizing a brand — should excite marketers, salespeople, and customer success managers.

So, customer loyalty = customer delight = more spending = less churn and more referrals = higher profits = happy customers and happy brands! And yet, look at the brands we do business with and whom we are loyal to – are we truly getting a differentiated experience from those brands? It is a question we will return to later in the series.

5

Loyal Customers

That customer loyalty should be one of the central pillars for any business or brand is obvious. Here comes more reinforcement from a blog post on Nicereply:

While it’s obvious that customers who come back to spend more money is good for business, there’s other, more subtle, benefits to loyal customers.

It’s like the old leaky bucket metaphor. Imagine a business as a bucket. Customers flow in and fill the bucket up. A successful business has a full bucket of customers (and profits).

However, imagine the bucket has a hole in it. Customers who flowed into the bucket start to leak out the hole. Losing customers is called churn, and it has a large effect on business growth. Even if you can somehow start filling the bucket faster, you’re still losing valuable customers. Patching up the hole (or improving customer retention) means keeping more customers in the business bucket. A 5% increase in customer retention increases business profits by 25%-95%.

If it cost the same amount to replenish the customers lost through the leak, then churn wouldn’t be such a big deal. Unfortunately, it’s much more expensive to get new customers into the bucket than continue to sell to existing customers. It’s estimated that new customers cost five times more to convert than existing customers.

Finally, loyal customers also make recommendations to family and friends.

There are many good reasons for making customer loyalty core to the brand. Yet, for most brands, the focus tends to be more on new customer acquisition rather than retention, which in turn means ensuring loyalty. New customer acquisition is where the bulk of marketing budgets get spent. Google and Facebook have made it very easy to point-and-click and pay for running acquisition campaigns. Acquisition-related metrics are the ones that get discussed in top management meetings. Everyone else is running ads, and so should the brand. Someone else’s customer needs to become the brand’s new acquisition, so attractive offers are dangled. And in all this, the quiet, repeat purchasing existing customer is all but ignored. Until it is too late.

This is what needs to be addressed by a rethink at two levels: making retention the new acquisition, and focusing retention efforts on the Best Customers. A loyalty program is seen as a great way to retain and reward the best customers.

6

Loyalty Programs

This is a good time to take a small detour into the world of customer loyalty programs and the data that goes into them. Our guide is Ajay Row. In a series of posts on LinkedIn a couple years ago, Ajay Row dug deep into customer loyalty programs.

To my mind, there are two purposes to a loyalty program:

- Reliably and consistently deliver profitable revenues in good times and bad. Revenues include both core revenues (company’s main business via retention, cross-sell, up-sell and new business via Member-Get-Member type programs and sharing positive reviews) and ancillary (typically membership fees, profits at redemption and money made via external partners who value the member base).

- To consistently deliver incremental actionable (and actioned!) insight. All the way from the overall base, through effective segments down to what could be millions of “audiences of one”.

The loyalty program is the price you pay to get these two. How does it work?

Loyalty programs deliver four levers:

- Data: at an individual member level includes profile, transaction, interaction, stated and inferred/observed preferences and finally derived data (i.e. data you build from data goes all the way from H / M / L value members through Cohorts to price sensitivity and basket type). This data, which is of course “internal” to the loyalty program, can be overlaid with data external to the program and even external to the company to build more value. Example, building geographical or seasonal models by individual members.

- Communication: the program has the opportunity, even the responsibility, after all the member has put up a hand and said they want to be a friend, to communicate respectfully and effectively. Communication keeps members engaged and typically covers one of three broad areas: brand/relationship building with the individual member, incremental reasons for a profitable behavior (e.g. point-based promotions that aren’t available to non-members) and program-related information (new status, number of points). Sometimes, a single point statement is enough to achieve all three ends.

- Rewards / Currency: the program, if well designed can deliver a currency other than money, one that can be even more valuable than cash depending on how effectively the redemption works, and the company controls the value! Using what we call the Value Per Point and Cost Per Point difference is one of the key levers by which loyalty programs make money. Point liability is fascinating game to play, but that will have to wait for another article.

- Recognition: the program can make your most valuable members feel exceptional by recognizing them as being special to you. And the program if designed with a little imagination can do this at an individual member level. Based on their value but also based on what is valuable to them.

Armed with these four levers, the loyalty program can deliver both reliably profitable revenues and incremental insights.

One of the key facets of any loyalty program is data. Here is how Ajay Row explains the different types of data:

-

Profile data: Member-given (e.g name, address, preferences, interests, etc.) — members puts up their hands and offer friendship, investing time to teach the organization about themselves. It the organization’s responsibility to think this one through carefully, what will we ask? How will we use it? Is it overly intrusive given our brand values?

-

Transaction data: System-generated (e.g. typically spends and related categorization data etc.)

-

Interaction data: System-collected (e.g. visits, social media related, eDM responses etc.)

-

Point related data: System-calculated(e.g. points earned, redeemed, balance, expired, bonus etc.)

-

Financial data: System-generated (e.g. transaction and customer profitability, point liability etc.)

-

Environmental data: Variously-collected, as far as possible, systematically (e.g. season, TOD/DOW, advertising running at the time)

-

Derived data: System-calculated (i.e. data derived, usually totaled, from some permutation or combination of the data sources above e.g. customer value growth, customer life-time value, cohort analysis, clusters and segments, correlations and causation etc.)

As Ajay Row summarises it: The objective of any loyalty program and hence analytics project is to: [Maximize the Sum of Customer Life Time Values across the Member Base].

As we will see going forward, calculating customer lifetime value (CLV) right to then correctly identify the Best Customers is the key to winning in customer loyalty.

7

Loyalty Metrics

Before we get to the “how” of rethinking customer loyalty, let us take a look at some of the metrics that have emerged over the years to measure customer loyalty:

Capillary offers a good summary of the many loyalty metrics:

-

Net Promoter Score: Gauge your customer loyalty with a Net Promoter Score, which asks one essential question: How likely are you to refer our service? Not only does this let you know how satisfied a customer is, but it also tests how likely they are to purchase again–without annoying them with a long list of questions.

-

Repurchase Ratio: The repurchase ratio gives you the number of customers who come back to your business repeatedly, divided by one-time purchasers.

-

Upsell Ratio: [This is] the ratio of customers who’ve bought more than one type of product to the customers who’ve bought only one.

-

Customer Lifetime Value: CLV is an understanding of the total revenue attributed by the entire relationship (including future purchases) with a customer.

-

Customer Loyalty Index: CLI takes into consideration multiple factors like NPS, upselling, and repurchasing. It accomplishes this through a questionnaire addressing these three essential points: “How likely are you to recommend us to your friends and family? How likely are you to buy from us again in the future? How likely are you to try our other products?”

-

Customer Engagement Score: [This] assigns every customer a score based on their individual activity and usage of your services.

All of these are good metrics. As I started thinking about customer loyalty, I thought about it differently. What would I as a business or brand want? A monopoly! Wouldn’t I love it if all my customers bought all their needs only from me? Each customer has a different threshold of spending. So, if I could figure out all that they were spending in that category and ensure they only buy from me, I could then ensure a competition-free business – which is the ultimate objective of a business and the path to supernormal profits. Of course, this never happens in reality. Customers have different needs and no business can cater to every one of their needs. Yet, some businesses come close. Google in Search and Microsoft in operating system software are two examples. Google’s Search gets our attention which is then monetised, while Microsoft gets our dollars for its near ubiquitous Windows and Office combo.

For a business, the key then is to identify the Best Customers in its category, and ensure it can get a maximum of them. Once they are acquired, the key would be to figure out what is their spending threshold in the category, and then aim to maximise wallet share of that spend. This approach can cut off the oxygen of revenue and profits from competitors. This needs fostering extreme customer loyalty. That is why I think we need to define customer loyalty differently: receiving more than 50% of the spending (attention or money) by a customer in the category.

To maxmimse profits, businesses need a new approach to thinking about loyalty and loyalty programs. This is where Velvet Rope Marketing comes in.

8

Rethinking Loyalty

I recently signed up on an online clothes shopping platform. They had a loyalty program. So I registered for that. I got the base level of points. Later that day, I asked my wife (a frequent shopper on the same online platform) if she had joined the loyalty program. She replied in the negative. So, I signed her up. And guess what – both of us had the same base level of points! Her entire purchase history of many years had been discarded when it came to loyalty and she was on a level playing field with me! Of course, in the future, she will earn more points because of her higher spending – but for now, it was like both of us were starting afresh.

This reminded me of the movie “Fifty First Dates” – where the heroine has short-term memory loss. She wakes up each day with no idea of who she is or who her family members are. So, she has to be reminded each day of her life stage. A video each day reminds her of her past so she can enjoy the waking hours better.

Many brands suffer from the “Fifty First Dates” syndrome. They ignore the past – and some even ignore the present and future. They think that a half-baked loyalty program is all that they need to ensure customer loyalty. What they are not seeing are the significant benefits that a well-designed program with a forward-looking CLV can do for customer retention.

Let’s add one more dimension into this mix. There are two multiplexes near my house, and I tend to split movie watching between the two. None of them remember me from my previous visits so for me there is no real experience differentiation other than the show time and availability of good seats. If they were to look at my transaction history, they would think I am a reasonably loyal customer – watching a movie every few weeks. But what they will not see is that I am giving half my business to their competitor!

This is why I emphasised the need to look at the spending in a category. That is the revenue and profit pool that needs to be maximised, and most brands have no idea about the money they are leaving on the table. And that’s the reason existing approaches to customer loyalty are flawed and need a rethink. Velvet Rope Marketing is the big idea that can transform not just loyalty programs but customer loyalty itself. VRM is the key to opening the door to creating a “profi-poly” (profits monopoly).

9

5 Cs of Loyalty

Here is a brief summary of the key ideas discussed so far:

- Every category has some “Best Customers” – who have higher spending power than others, and therefore are more profitable than others

- Identifying, acquiring and retaining these customers is critical for a business

- These category-wide Best Customers can be instrumental in helping businesses build a profits flywheel

- A standard loyalty-and-rewards program is not going to be enough for retaining such customers

- What these customers need is something special – a differentiated experience

- This is where Velvet Rope Marketing (VRM) comes in – by using tech and human-assistance to roll out the red carpet by offering exclusivity, ease and access

VRM is the secret sauce to ensuring customer loyalty and higher profits. Using CLV, it becomes possible to identify the current Best Customers for a business. Decoding the customer genome of the Best Customers offers the attributes to ensure more targeted new customer acquisition. This is the cycle that every business needs to drive.

And yet, the surprise is that few do it. Most think that rolling out a loyalty program is good enough to ensure that they will attract the best customers in the category and retain them. Nothing could be further than the experienced reality.

So, let’s now look ahead. How can VRM anchor the transformation of customer loyalty and loyalty programmes? There are 5 key ideas that we need to discuss:

- Committing to a CDP: all customer data needs to be collected into a single customer data platform

- Calculating CLV right: the right analytical models are needed to predict CLV to serve as the base for customer segmentation and experience differentiation

- Crafting the Customer Experience: marketing creativity and technology platforms need to come together to create a magical experience for the Best Customers so they maximise their category spending with the brand

- Creating a Continuous Learning system: use AI-ML (Artificial Intelligence and Machine Learning) to become better each day with the new data that streams in so changing customer behaviour and purchase patterns can be identified early

- CEO prioritisation: none of this will happen without a clear vision and roadmap from the leader at the top – and a recognition that VRM-powered loyalty is not just a marketing program but the most important business imperative

We will discuss each of these 5 Cs in turn – CDP, CLV, CX (customer experience), CL (continuous learning) and CEO.

10

Customer Data Platform

The first step in using VRM to anchor a transformation in customer loyalty is to collect all the customer data into a single unified database. Data can come from multiple sources – one needs to look at all the touchpoints that a customer has with the brand.

Here is an explanation from Exponea about what a Customer Data Platform (CDP) does:

…It’s a kind of database software: one that creates persistent, unified records of all your customers, their attributes, and their data. A good CDP should both easily integrate with your existing data and allow for easy retrieval of the data it stores.

A CDP builds a complete picture of your customers on an individual level. It collects 1st party customer data (transactional, behavioral, demographic) from a multitude of sources and systems, and links that information to the customer that created it.

This creates a 360-degree customer profile, also called a single customer view, which can then be used by 3rd party tools or built-in marketing automation tools to execute marketing activities and analyze their performance.

Here is more from the CDP Institute:

A unified customer experience is impossible without unified customer data. Most data originates in separate systems that weren’t designed to share it with anything else. Traditional methods for collecting that data into unified customer profiles, such as an enterprise data warehouse, have failed to solve the problem. Newer approaches, like “data lakes”, have collected the data but failed to organize it effectively.

The Customer Data Platform is an alternative approach that has had great success at pioneering companies. A CDP puts marketing in direct control of the data unification project, helping to ensure it is focused directly on marketing requirements. CDPs apply specialized technologies and pre-built processes that are tailored precisely to meet marketing data needs. This allows a faster, more efficient solution than general purpose technologies that try to solve many problems at once.

The idea of a CDP has been around for a long time – its name has changed through the times. Enterprise Data Warehouse, Customer Relationship Management database, Data Lake, and so on. The key point is to collect all the data to help build a unified view of a customer which is the foundation for all customer engagement activities. With a CDP in place, the next action of calculating CLV can be done.

11

Customer Lifetime Value

Once the CDP is in place and all customer data is aggregated, the next step in using VRM to anchor a transformation in customer loyalty is to calculate the customer lifetime value (CLV) as a prelude to segmenting customers.

Here are a few quotes from Wharton professor Peter Fader on CLV, sourced from Retail Touchpoints:

The differences [between customers] are staring us in the face. And not only are customers vastly different from each other, but their lifetime value varies by orders of magnitude.

If you can come up with a lifetime value measurement, it’s like a number shining over each customer’s head. CLV provides a different framework for running a retail or brand business. Rather than focusing on product, you would want to figure out what you could do for these really valuable customers. What products and services should you offer to enhance the value of those customers, and to find more customers like them.

The truth is you’ll only get so far with innovation and efficiency; to succeed, you need to think of your customers as individual entities.

If you can quantify the CLV, you can figure out what kinds of discounts you should be offering — or, what kinds of value-enhancing activities you should offer instead of discounts.

Focusing on CLV doesn’t mean ignoring the remaining 80% of customers, but it does mean paying more attention to the high-value 20%.

There are many ways CLV can be wrongly calculated. Many brands just use an average of transactions done in a period of time to estimate CLV. A flawed CLV calculation will lead to an incorrect identification of Best Customers.

The right way to calculate CLV is to look at the recency and frequency of transactions, and then estimate future transactions for each customer. This is the model we use in VRM, building on work done by Peter Fader and others.

Here is an explanation of a CLV model proposed by Fader, Bruce Hardie and Ka Lok Lee in a paper entitled “RFM and CLV: Using Iso-Value Curves for Customer Base Analysis”:

The challenge we face is how to generate forward looking forecasts of CLV. At the heart of any such effort is a model of customer purchasing that accurately characterizes buyer behavior and therefore can be trusted as the basis for any CLV estimates. Ideally, such a model would generate these estimates using only simple summary statistics (e.g., RFM) without requiring more detailed information about each customer’s purchasing history.

In developing our model, we assume that monetary value is independent of the underlying transaction process. Although this may seem counterintuitive (e.g., frequent buyers might be expected to spend less per transaction than infrequent buyers), our analysis lends support for the independence assumption. This suggests that the value per transaction (revenue per transaction × contribution margin) can be factored out, and we can focus on forecasting the “flow” of future transactions (discounted to yield a present value). We can then rescale this number of discounted expected transactions (DET) by a monetary value “multiplier” to yield an overall estimate of lifetime value:

CLV = margin × revenue/transaction × DET

Once the CLV has been correctly calculated, the easy next step is to segment customers and thus get a clear idea on the Best Customers.

12

Customer Experience

We now come to the third step – the CDP is in place, the CLV has been calculated, and the Best Customers have been identified. The next focus is on creating a differentiated customer experience for the Best Customers so they maximise their spend with the brand, and also refer friends and family members. The attributes of the Best Customers can then be used to acquire new customers with similar characteristics, thus creating a Best Customers flywheel. As we discussed earlier, every category has a limited number of Best Customers, and a brand’s focus should be to maximise such customers. This is the key to generating ever-increasing profits despite competitive pressures.

Velvet Rope Marketing is the solution that can provide the differentiated customer experience. I have written extensively about VRM in previous essays:

- Velvet Rope Marketing

- Becoming Chief Profitability Officer

- The One Number to Predict Profits

- Rethinking Referral Marketing

Here is an overview of how VRM works:

The big idea in VRM is in differentiated customer experiences that go beyond a loyalty program. Every aspect of the business must be involved in ensuring that Best Customers are treated like royalty. Because such experiences are rare, businesses which do this will stand out. All we have to do is to look at our own interactions with brands – in most cases, we will find that even where we are loyal customers, the experience we get is ordinary. This is the monotony that brands have to break, and VRM provides an ideas framework to do exactly that.

More information is available on VelvetRopeMarketing.com, and the Ideas page gives a number of suggestions on how to get started with creating memorable customer experiences.

13

Continuous Learning

CDP, CLV and CX (customer experience) are the first three steps in the process of transforming loyalty using VRM. The fourth step is CL (continuous learning) – creating a feedback loop where new data is ingested by AI-ML systems to create an even better system. Daily, and forever. This is a marketer’s dream – where every action taken by a customer is fed back into the system, and that is used to further personalise the content and experience.

What used to be a slow, time-consuming process by analysts can now be done by machines faster, better and cheaper. This lays the foundation for the 4Rs of customer experience – right message to the right person at the right time on the right channel. CL is at the heart of this world of “omnichannel personalisation”. It is even more important to do this for the most important customers.

So, what exactly is CL? Here is a short overview from Vincenzo Lomonaco:

Continual Learning (CL) is built on the idea of learning continuously and adaptively about the external world and enabling the autonomous incremental development of ever more complex skills and knowledge.

In the context of Machine Learning it means being able to smoothly update the prediction model to take into account different tasks and data distributions but still being able to re-use and retain useful knowledge and skills during time.

The simplest application of CL is in scenarios where the data distributions stay the same but the data keeps coming. This is the classical scenario for an Incremental Learning system.

You can think of a lot of applications like Recommendation or Anomaly Detection systems where data keeps flowing and continually learning from them is really important to refine the prediction model and in the end improve the service offered.

However, nowadays, for most of the commercial DL applications it’s ok to re-train the model from scratch with the cumulated data. The game becomes really interesting instead when the scenario keeps changing over time. This is where Continual Learning really shines and other techniques are unable to solve the problem.

In the world of marketing, the rise of digital customers is creating a continuous stream of data. Machines are best placed to process this and then provide the necessary guidance on the next best actions for every customer. While brands can apply this to all customers, the critical requirement must be to do this for the Best Customers. These 20% customers are where all personalisation efforts need to be super-charged. CL is the way to make systems better daily. If a system becomes 1% better each day, over a year the improvement is 3700%, or 37 times. That’s the power that an AI-ML powered CL system can deliver.

14

CEO Commitment

We have discussed the first four elements of how VRM can transform customer loyalty: CDP, CLV, CX and CL. It is time for the fifth and final ‘C’ – and perhaps the most important of them all. CEO. If the digital transformation of marketing has to succeed, then it has to become the most important priority of the CEO.

A CEO should remember Peter Drucker’s wise words: “Because the purpose of business is to create a customer, the business enterprise has two–and only two–basic functions: marketing and innovation. Marketing and innovation produce results; all the rest are costs. Marketing is the distinguishing, unique function of the business.”

Marketing as a function is also being impacted by technology. The customer is becoming increasingly digital and engaging with the business through many different touchpoints. What customers want is a continuity of experience. For example, if a Best Customer who has primarily shopped online enters an offline store, the right time to identify such a customer to provide an enhanced experience is right at the moment of entry, and not at checkout. This can only be possible if all customer interaction points are digitised. Customers are willing to share personal information if they know that data can provide them with a special, superior experience.

All that a CEO has to do is to wear the hat of a customer, and then see the experience provided. We are all customers of many different brands. Think about those brands where we have a deep connection with– both from an emotional and financial standpoint. Are we really special for the brand? Will the brand miss us if we are gone? Sadly, for most brands, the answer will be a No.

Every CEO says that customers are the most important focus for their business. And yet, much of the nitty-gritty is left to the marketing department. The ideas that we have discussed call for a complete transformation of the way businesses think about marketing. Such effort cannot be delegated – it has to be led from the front. For the VRM initiative to succeed, it needs to cut across every function that touches the customer – and therefore it has to be on the CEO’s agenda.

That is the opportunity CEOs have – to become the leaders in the effort to completely transform the way customers interact with their brands. Here, the focus needs to be on the experience provided to the brand’s Best Customers. A loyalty program is not the be-all and end-all of engagement. Rather, it may actually lead CEOs and businesses down a sense of false satisfaction. This is where the idea of Velvet Rope Marketing comes in. It can be the fulcrum for the transformation that customer loyalty needs. Forward-thinking CEOs can be the customer centricity champions in this journey and put their companies on the path to capturing industry profits and becoming a “profi-poly.”